We provide free but advertising supported comparsion service for different credit cards, the offers that appear on this site are from third party advertisers from which we receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). We do not guarantee to offer all financial services companies or products on this website.

Capital One® Secured Mastercard®

Additional Information

Sign-up Bonus

Rewards

Balance Transfers:

A balance transfer is a way to move credit card debt from one credit card to another with the goal of saving money on interest.

Intro Balance Transfer APR N/A

Regular Balance Transfer APR 26.99% Variable

Balance Transfer Fee $0

Costs:

Annual fee

$0

Penalty APR

N/A

Late Fee

Up to $39

Returned Payment Fee

None

Additional Cards Annual Fee

N/A

Foreign Transaction Fee

None

Foreign transaction fee

None

Getting started is easy

Complete and submit your application for a Secured Mastercard from Capital One.

Upon approval of your application, you’ll be notified of the security deposit amount required for your account.

Make your security deposit, and receive your card in 2-3 weeks.

Cash Advances

Borrowing cash on your credit card is a cash advance. Cash advances usually come with very high fees. Even wors

Application Requirements

How To Apply Capital One® Secured Mastercard®

If you are keen to apply for the Capital One® Secured Mastercard®, simply click on the "Apply Now" button below to be taken to the credit card official website to complete the credit card application form. Our website will not record any personal information about you, and the whole process will not affect your credit score.

To complete the form, you should enter your name, address, telephone number and email address in the application form. You may also need to list your annual income and monthly mortgage or rent.

The credit card also asks for your date of birth, social security number, mother's maiden name, and driver's license number as part of its credit check.

When you have completed the form, the application needs to be reviewed, and you will receive your Capital One® Secured Mastercard® soon if your audit passes.

How To Use Capital One® Secured Mastercard®

Where Can You Use

It can be used anywhere MasterCard is accepted.

Pay Your Bill On Time

You need to make on-time payments. A late payment could hurt the credit score or the limit of your credit card.

Something About The Card

You need to make all payments on time to avoid incurring penalty fees (not to mention a hit to your credit report). Consider signing up for autopay so you don't forget. Making timely payments is one of the best ways to establish a healthy credit history.

You should consider increasing your initial credit line by making a higher-than-required security deposit. Doing so can help improve your credit utilization ratio, another major factor in your overall credit score.

Avoid taking cash advances, the fees for which can quickly increase your total amount owed.

You need to pay your regular balance in full every month to avoid accruing higher-than-average interest charges. Not to mention, carrying a balance can make it more difficult to demonstrate your reliability to card issuers.

Credit Card Reviews

More Credit Cards Like Capital One® Secured Mastercard®

-

Capital One® Secured Mastercard® -

Capital One® Platinum Credit Card -

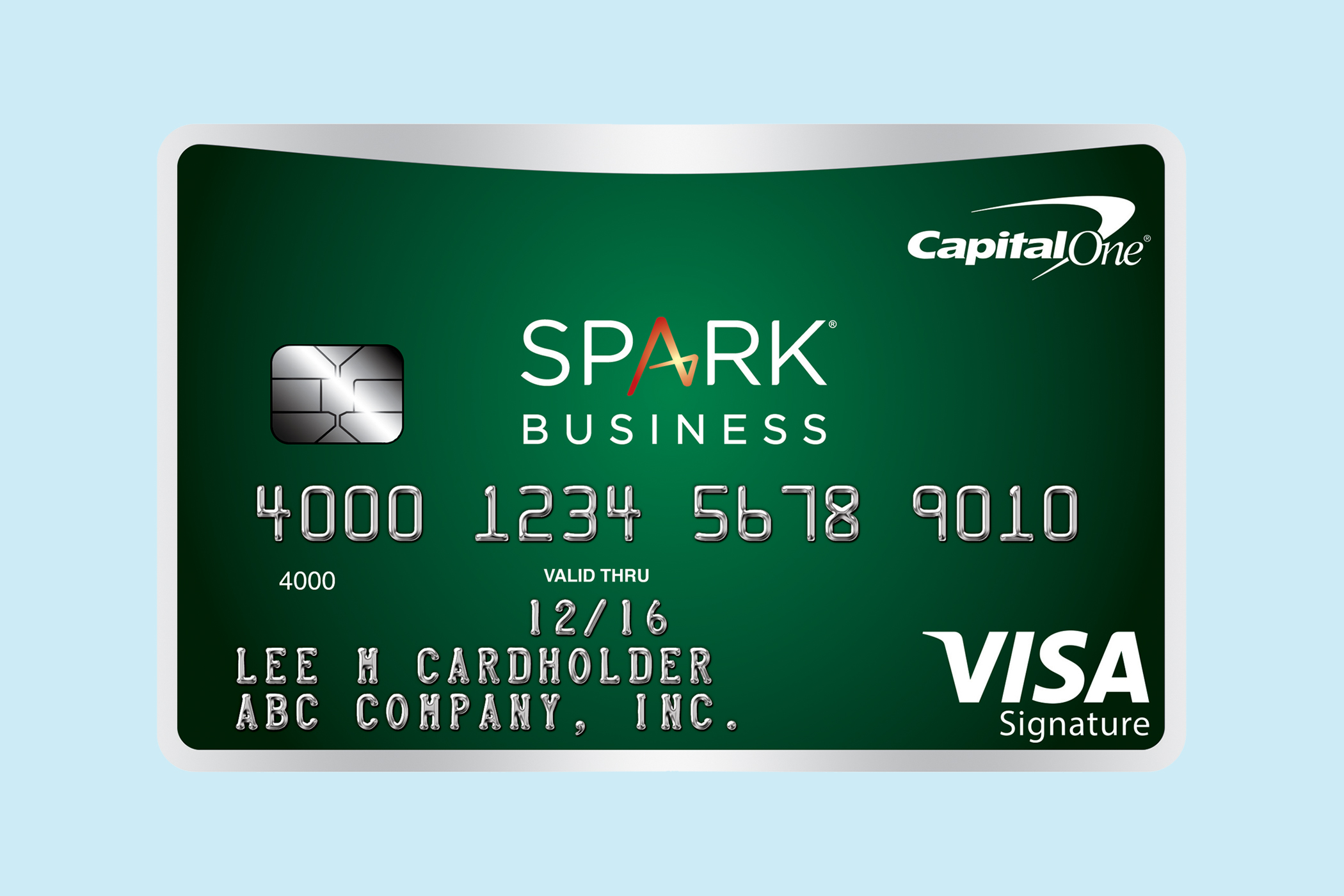

Capital One Spark® Cash Credit Card -

Capital One® SavorOne℠ Cash Rewards Credit Card -

Capital One® Savor® Cash Rewards Credit Card -

Capital One® Spark® Classic for Business -

Capital One QuicksilverOne Cash Rewards Credit Card -

Capital One Venture Rewards Credit Card

-

Macy's Credit Card

2 Cards -

Target Credit Card

1 Cards -

Sams Credit Card

1 Cards -

Lowe's Credit Card

4 Cards -

Milestone® Mastercard® - Bad Credit Considered

1 Cards -

Best Buy Credit Card

2 Cards -

Walmart Credit Card

2 Cards -

Victoria's Secret Angel Credit Card

1 Cards -

Old Navy Credit Card

4 Cards -

JCPenney Credit Card

2 Cards -

Amazon Credit Cards

3 Cards

Credit Cards You May Like

About credits-life

About three-quarters of Americans have at least one credit card,In fact, the average person has 3.4 cards. But whether you have a wallet full of plastic or have never charged a purchase in your life, you should know how to apply for a credit card the right way when the time comes. getting approved for a credit card requires proactive planning that should start long before you apply. That's why credits-life born, we aim to help you to find the right credit card, and then successfully apply a credit card.

How To Apply For A Credit Card

Credit card applications are straightforward, but you'll need to meet some minimum financial requirements to get approved for the best credit card offers. Learn how to apply for a credit online and what to expect after you click submit.

- Knowing your credit score and what's on your credit report can help you determine what products to apply for. If you have fair credit, for example, you may not want to apply for a card that clearly states that only applicants with excellent credit will be approved.

- If you don't have good credit, you may find it difficult to get approved for a card with a large sign-up bonus and a lucrative reward structure. Each credit card application ends up on your credit report, so the Nerds recommend using our credit cards comparison tool to find a card that fits your credit profile before applying.

- If the card allows balance transfers, you may request to have balances transferred from other credit card accounts to the new card.

- To apply for a credit card in the US, you’ll need a valid Social Security number and a positive credit history. The best rewards credit cards may require at least three to five years of good credit history, and some more than seven.

Write A Review