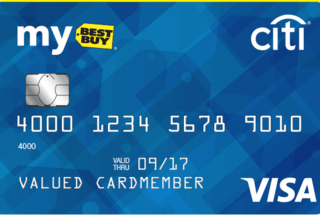

Best Buy 6 or 12 month financing on Storewide Purchases

6 months

on storewide purchases $199 and up when you use your My Best Buy® Credit Card.

12 months

on storewide purchases $399 and up when you use your My Best Buy® Credit Card.

6 months

on storewide purchases $199 and up when you use your My Best Buy® Credit Card.

12 months

on storewide purchases $399 and up when you use your My Best Buy® Credit Card.

First, create My BestBuy account

After login, enter your name, address, telephone number and email address in the application form. You must list your annual income and monthly mortgage or rent.

Quick access to this card? Click on the Apply Now button.

Where Can You Use MY BEST BUY VISA® Card?

The My Best Buy Credit Card can only be used at Best Buy and BestBuy.com and anywhere Visa cards are accepted.

Pay Your MY BEST BUY VISA® Card Bill On Time

You need to divide the balance by the length of the period to determine the appropriate monthly payment, which will fully pay the balance at the end of the period. There is no penalty for prepaying, so you should do what you can.

Something About MY BEST BUY VISA® Card Rewards

5% back in rewards at Best Buy and BestBuy.com, or deferred financing for eligible purchases.

3% back in rewards at Gas Stations, Grocery Stores (through December 2018), Home Furnishing Stores (through December 2018).

2% back in rewards at Restaurants

1% back in rewards for all other purchases

About three-quarters of Americans have at least one credit card,In fact, the average person has 3.4 cards. But whether you have a wallet full of plastic or have never charged a purchase in your life, you should know how to apply for a credit card the right way when the time comes. getting approved for a credit card requires proactive planning that should start long before you apply. That's why credits-life born, we aim to help you to find the right credit card, and then successfully apply a credit card.

Credit card applications are straightforward, but you'll need to meet some minimum financial requirements to get approved for the best credit card offers. Learn how to apply for a credit online and what to expect after you click submit.

We provide free but advertising supported comparsion service for different credit cards, the offers that appear on this site are from third party advertisers from which we receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). We do not guarantee to offer all financial services companies or products on this website.

The credit score is a three-digit number relating to your credit worthiness. Banks or issuers use it to determine if they will approve you for a credit card. In credits-life, credit score ranges can be roughly equated to levels of credit, from limited credit to excellent credit.

|

Credit Score |

|

|

Excellent Credit |

750 — 850 |

|

Good Credit |

700 — 749 |

|

Fair Credit |

640 — 699 |

|

Bad Credit |

300 — 639 |

|

Limited Credit |

Less than 3 years of credit history |

Applying for a credit card designed for people in the score range above does not guarantee you will be approved. Many other factors will go into credit card approval decisions.

Write A Review

this credit card is the worst credit card I had in my life. I did big mistake when I had this credit card. they charges me with highest interests when I talk to customer service on the phone so they can do something about those high charges of interests they said we can do nothing about it they were unprofessional and they talk with bad attitude I am going to pay off and close it. DO NOT GET THIS CREDIT CARD. they will rub you

"I got this card because I didn't want to buy a brand new TV out of pocket, I really should have just bought the TV outright. This card dropped my credit by 3 points just getting it. They sent no information to me and when I called and asked they told me they told me they had sent the bills even though I know for a FACT they did not. I ended up getting so upset I just paid the full amount after the second month straight of fees. No card was ever given to me at any point. This is without a doubt the worst card I've ever had. I would strongly recommend that you do not get this card.

"While purchasing a tv at Best Buy the clerk convinced me to get the VISA card because I would get $30 off my purchase. I agreed. A year later I noticed that even when making double the minimum payment (early) every month by balance barely went down. The interest is 45%! Every month Best Buy ads at least $45 to my balance. That's paying over $500 a year on a balance less that $1900! This is sanctioned thievery. DO NOT ever get this card.

"Don’t make the mistake and do what I did. Last year I went to Best Buy’s and workers were hounding me to get a credit card with them. The lady said it’s a good card and it’s like getting free money. So I was stupid and opened a card. Long story short,1 year later my balance was 900.00 something & so they slammed me with a 500.00 interest fee and want it paid NOW so now not only is my card negative but it is messing with my credit score and instead of me having 726 I have 543 as a credit score so I called them to maybe get a payment plan but all’s they said was there’s nothing they can do for me with a attitude!!! I’m ripping this stupid ass card up and they can take the payments I’m gonna pay them and they can stick it we’re the sun doesn’t shine!!!! SCAMMERS!!!!!!!!!!!

"I have been seeking resolution since the end of June, 2018 regarding my Best Buy Citibank credit card statement, about which I have never received and about which Citibank credit card claims I signed up for e-statements. I have called, composed a 3 page letter and faxed it. I have called again, as I am not at all pleased nor have I received any satisfaction as to how the credit card company has replied or handled the case. Long story short, it is my customer again company. While Citibank has credited two late fees back to me, the end result is that I never received a paper statement for a $20 purchase so the late fees piles up for 2 months and my credit scored drop 100 points. Luckily my score was solid to begin with but that is beside the point. The credit card has claimed that it is my fault for not receiving the e-statements since I can not offer any proof. How can I offer proof if I never received an e-statement. They have treated me like an ignorant person who knows nothing about technology as well as an idiot who doesn't know how to check my emails. I explained that I do not do e-statements. Period. I also explained that if I received an email reminder via Best Buy re: Geek squad protection plan, why am I not receiving e-statement? THEY HAVE NO ANSWER TO THAT. I have told them they have lost a customer and they seem to not care about that or my situation.

"